Innovation in the payments space is reaching a critical inflection point, where access to mobile, comfort with online (i.e. banking, purchasing, investments, etc.) and emergence of new technology and payment options are starting to change consumer habits, behaviors and expectation.

How consumers pay for everything from groceries to utility bills is a telling and personal reflection of their daily lives. As consumer behaviors shift, we know that their choice of payment tools, and priorities for benefits, evolve as well.

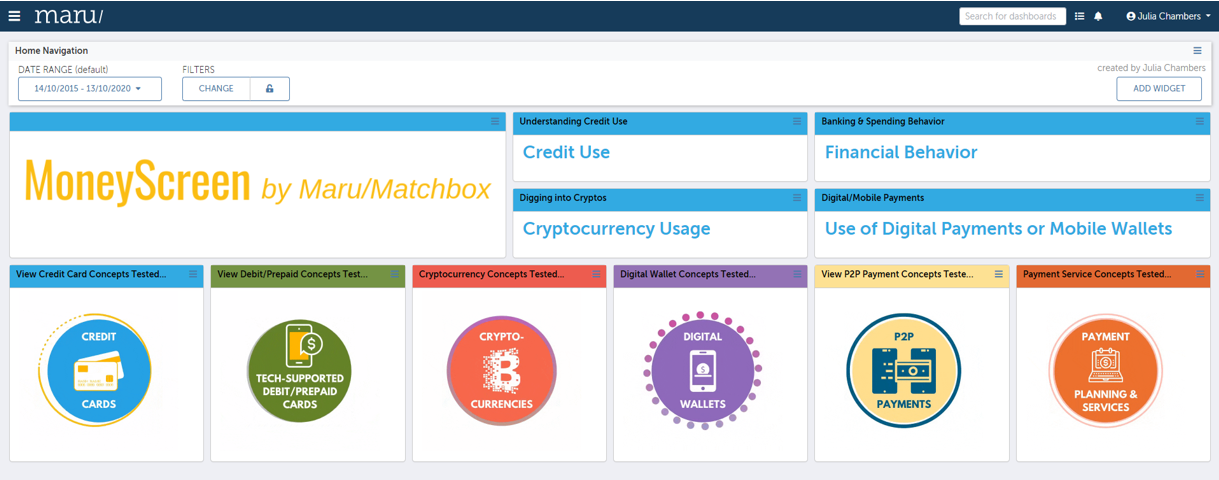

MoneyScreen benchmarks and tracks payment innovation across all aspects of the industry and provides access to well profiled consumers for ongoing concept development and testing.

Concepts are tested, benchmarked and contextualized within several targeted categories:

- FI-issued Travel Cards

- FI-issued Cashback Cards

- FI-issued Non-Reward/Balance Transfer Cards

- Co-brand Credit Cards

- Tech-forward Debit/Prepaid Cards

- Digital wallets

- P2P Tools

- Cryptocurrencies

- Payment Services (e.g. installment plans)

Track consumer usage of these categories over time, and dive into point-in-time adoption, interest and barriers to use of specific payment products ideas and in-market solutions. This product marries years of robust data, with expert analysis of the landscape by Matchbox’s team of Financial Services researchers.

Enjoy expansive industry and competitive intelligence at your fingertips.

Benefits

- See how the market is changing, before it happens

- Uncover unmet needs and white space opportunity

- Gain insights from the people that matter most—your target audience

- Optimize your product/service

- Co-create new concepts

- Fine tune campaign messaging

- Uncover the profile of consumers most likely to adopt a product

- Leverage System 1 methodology to uncover the unconscious appeal of payment concept features and the prioritization of the same

|